Introduction

In today’s fast-paced, digital-first world, businesses are struggling to keep up with increasingly complex tax regulations and real-time financial reporting demands. The global tax management market is responding and growing at a remarkable rate. Here’s why this matters to you and what to look for in a solution.

🔍 Market Growth at a Glance

- A jump from USD 23.4 billion in 2024 to USD 26.3 billion in 2025, at a CAGR of 12.5%.

- Projected to reach nearly USD 41.8 billion by 2029, sustaining a 12.3% CAGR.

- Other forecasts align: ~USD 29 billion in 2025, growing to USD 47.7 billion by 2030 at 10.3% CAGR.

Why this surge?

Drivers Behind the Explosion

- Escalating Tax Complexity

- Ever-changing laws and multi-jurisdiction obligations make manual processes overwhelming.

- Digital Transactions Surge

- E-commerce, fintech, and global supply chains generate vast data volumes, demanding smart tax engines.

- Cloud & Automation Wave

- Shift to cloud-based platforms and AI-driven compliance reduces manual efforts and error rates.

- Global Business Expansion

- Enterprises expanding worldwide need unified systems for consistent compliance across borders.

What Solutions Should You Prioritize?

- Comprehensive Suite – Tools must cover software and services across direct/indirect taxes.

- Cloud-First Approach – Enables collaboration, scalability, and real-time oversight.

- AI & Analytics – Offer intelligent decision support, anomaly detection, and risk insights.

- Impartial & Credible Vendors – Top providers include Intuit, SAP, Thomson Reuters, Avalara, Vertex, Sovos, ADP, H&R Block, and others.

Implications for Businesses

- Cost Efficiency – Automation slashes compliance costs and penalties .

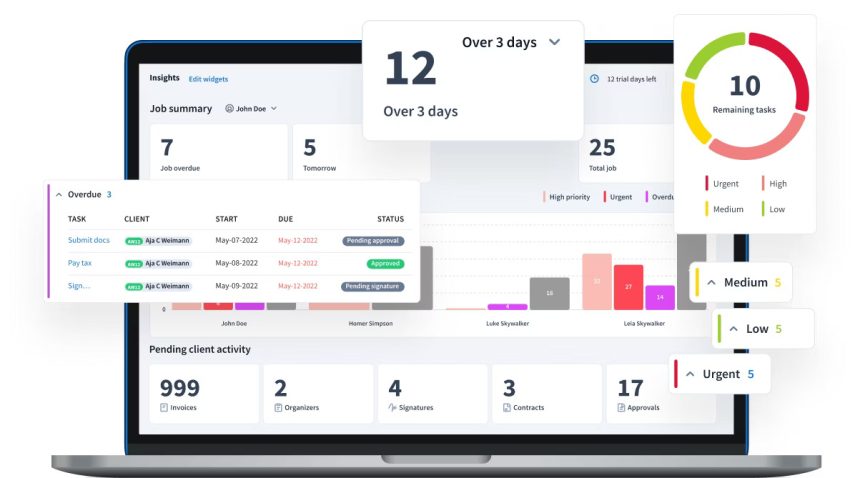

- Operational Agility – Real-time dashboards help businesses respond proactively to changes.

- Risk Mitigation – Audit-readiness and error tracking enhance governance.

- Strategic Value – Tax data becomes an asset for planning and forecasting.

✅ Conclusion: Time to Rethink Tax

The soaring tax management market—now moving beyond USD 26 billion—is a direct response to a world of rapid digitalization and regulatory uncertainty. Cloud-powered, AI-driven tax platforms are no longer optional; they’re essential tools for modern businesses.

If your organization still relies on spreadsheets or legacy systems, it’s time to upgrade, not just to safeguard compliance, but to gain real-time clarity and strategic footing.

Adapted for Udyamee India Business Magazine

Based on insights from the MarketsandMarkets “Tax Management Market” report.

Image Credit: Taxdome

(The Business Research Company) (Research and Markets) (Virtue Market Research)