Brutal, dangerous truths about regulatory gaps that can shut down your business overnight, even when sales are strong and customers are happy.

Introduction

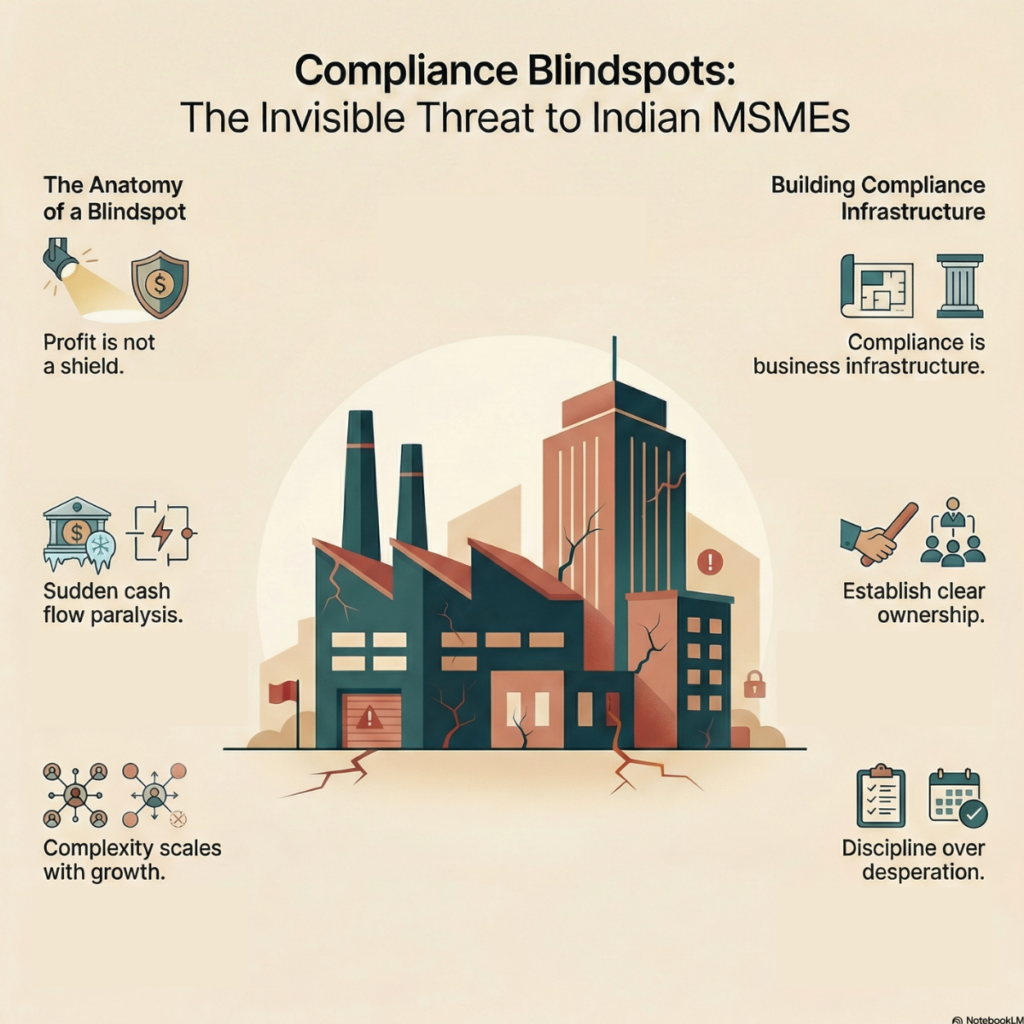

Compliance Blindspots are the silent killers most profitable MSMEs never see coming.

Many Indian MSMEs are profitable on paper. Orders are coming in, factories are running, and customers are happy. Yet suddenly, the business hits a wall. Bank accounts get frozen. Notices arrive. Plants are forced to shut down. Growth stops overnight.

The reason is rarely sales or quality. The reason is Compliance Blindspots.

These blindspots don’t shout. They wait quietly. And when they strike, they don’t give second chances.

What Are Compliance Blindspots?

Compliance Blindspots are areas where businesses unknowingly ignore, delay, or underestimate legal and regulatory requirements. Founders often assume compliance is paperwork. Something to “manage later.”

But in India, Compliance Blindspots can shut down a profitable MSME faster than market competition.

This is not fear-mongering. This is reality.

Profit Does Not Protect You From Compliance Blindspots

Many founders believe, “We are paying taxes and doing honest business. Nothing will happen.”

That belief itself is a Compliance Blindspot.

Authorities don’t check intentions. They check documents, filings, timelines, and records. A profitable business with weak compliance systems is more exposed than a small struggling unit.

Profit attracts attention. And attention exposes gaps.

Compliance Blindspots Grow With Business Size

When a business is small, mistakes go unnoticed. When it grows, the same mistakes become violations.

New employees, higher turnover, larger vendor networks, multiple states, and bigger factories all increase compliance complexity. But most MSMEs continue with the same accountant, the same outdated systems, and the same casual approach.

This is how Compliance Blindspots expand silently during growth.

“We’ll Fix It Later” Is the Most Dangerous Sentence

Deferred compliance is not postponed compliance. It is ignored compliance.

Labour laws, factory licenses, ESI, PF, GST classifications, environmental permissions, safety audits, each delay adds risk. And risks don’t expire.

By the time founders discover their Compliance Blindspots, fixing them costs ten times more in penalties, legal fees, and reputational damage.

Compliance Blindspots Can Block Cash Flow Overnight

This is where it gets brutal.

- GST mismatches block refunds

- Bank accounts get frozen

- Payments get held due to missing documents

- Government tenders reject bids instantly

A profitable MSME can suddenly struggle to pay salaries because of Compliance Blindspots.

This is why some businesses say, “Profit hai, paisa nahi hai.”

People Handling Compliance Are Often Underpowered

In many MSMEs, compliance is handled by:

- A junior accountant

- An external consultant who visits once a quarter

- Someone copying last year’s files

No authority. No system. No review.

Founders assume compliance is being “taken care of.” In reality, Compliance Blindspots are forming because no one owns the responsibility end-to-end.

Mature MSMEs Treat Compliance as Infrastructure

Well-run MSMEs do something different.

They:

- Document processes

- Schedule internal audits

- Track compliance like financial metrics

- Assign accountability

- Review risks during expansion

For them, compliance is not paperwork. It is business infrastructure.

They understand that removing Compliance Blindspots is essential for sustainable scale.

How MSMEs Can Start Fixing Compliance Blindspots

You don’t need a large legal team. You need discipline.

Start with:

- A compliance checklist mapped to your business size

- Clear ownership, not assumptions

- Quarterly internal reviews

- Documentation that can survive scrutiny

- Professional advice during expansion, not after

Most importantly, founders must stop treating compliance as a back-office irritation.

Final Thought

Markets change. Customers leave. Vendors fail. But Compliance Blindspots are self-created risks.

Profitable Indian MSMEs don’t collapse because they lack ambition. They collapse because invisible gaps were allowed to grow unchecked.

In business, what you ignore quietly today can destroy loudly tomorrow. And compliance is never optional.

Image credits: Created with NotebookLM

For more articles on startup growth, fundraising strategies, and business insights for Indian founders,

visit: Udyamee India Magazine