Introduction

For many years, India’s e-commerce growth was driven mainly by metro cities like Delhi, Mumbai, Bengaluru, and Hyderabad. These cities shaped online shopping habits and attracted most brand attention. But that story is changing fast. Today, Tier 2 and Tier 3 India is leading the next phase of digital commerce growth.

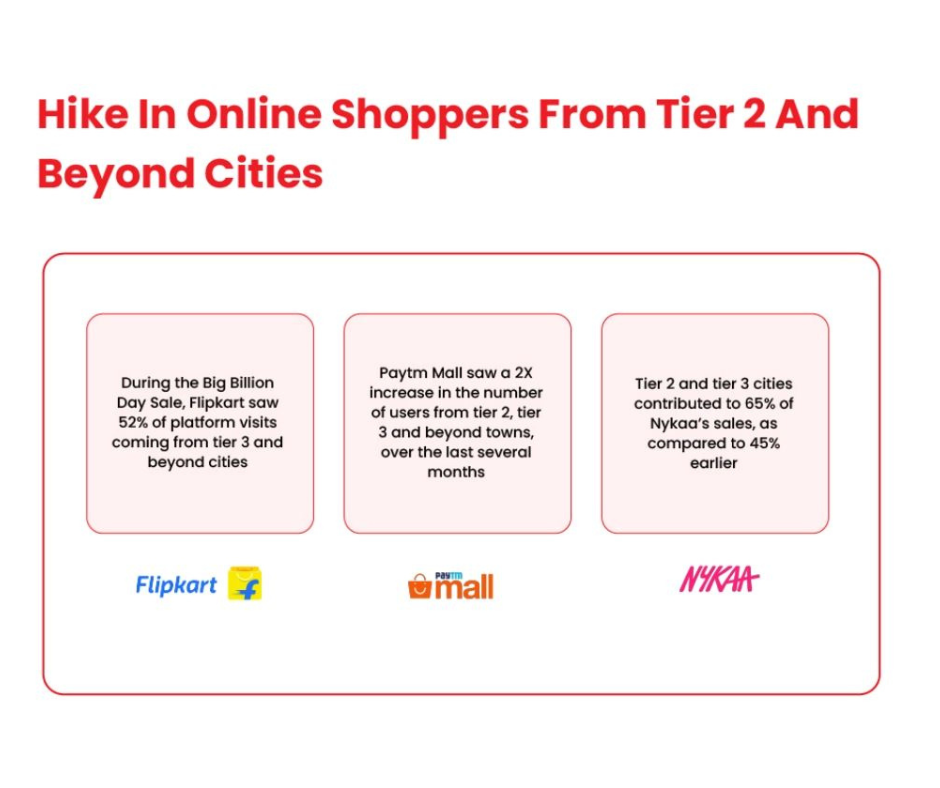

Platforms like Flipkart now receive more than half of their orders from non-metro cities. Meesho built its entire business by focusing on smaller towns and local sellers. With rising incomes, better internet access, digital payments, and strong logistics, smaller cities are no longer “emerging.” They are driving demand.

For Indian businesses, this shift is not optional. It is the biggest opportunity of this decade.

1. Massive Population With Real Buying Power

Cities such as Jaipur, Indore, Surat, Coimbatore, Patna, Madurai, and hundreds of smaller towns together represent over 300 million people. Tier 2 and Tier 3 India has a young population, smaller families, and rising disposable income.

Consumers here may shop carefully, but they shop consistently. Brand loyalty is stronger, competition is lower, and word-of-mouth travels fast. For businesses, this means volume with stability.

2. Smartphone Access Changed Everything

Affordable smartphones priced between ₹6,000 and ₹8,000 brought internet access to millions of households. This created a generation of mobile-first users who browse, compare, and buy directly from apps.

In Tier 2 and Tier 3 India, product discovery happens through short videos, WhatsApp sharing, and creator content rather than websites. Businesses that design for mobile win faster.

3. Cheap Data Built Digital Confidence

India’s low data costs turned casual users into confident online shoppers. People now spend hours watching reviews, checking prices, and understanding product features.

This digital comfort directly pushed e-commerce adoption across Tier 2 and Tier 3 India, especially among first-time buyers who now trust online platforms more than ever.

4. UPI Created Trust in Online Payments

UPI removed the fear of online payments. People already using PhonePe, Google Pay, and Paytm for daily transactions became comfortable shopping online too.

While Cash on Delivery still exists, trust in digital payments across Tier 2 and Tier 3 India has increased sharply, helping platforms reduce returns and improve efficiency.

5. Logistics Finally Reached Smaller Cities

E-commerce companies invested heavily in warehouses, delivery hubs, and kirana partnerships. Today, deliveries to smaller towns take only one extra day compared to metros.

Flipkart’s local kirana delivery model helped solve last-mile challenges and strengthened trust in Tier 2 and Tier 3 India.

6. Local Language and Cultural Connection Matters

Consumers prefer apps and support in Hindi, Tamil, Telugu, Bengali, Gujarati, Marathi, and other regional languages. This shift made e-commerce more welcoming for first-time users.

In Tier 2 and Tier 3 India, regional influencers and local storytelling play a huge role in building emotional trust with brands.

7. Different Shopping Behaviour, Better Loyalty

Shoppers in smaller cities are value-conscious. They focus on durability, pricing clarity, and recommendations from friends or creators.

Businesses that understand these behaviour patterns succeed faster in Tier 2 and Tier 3 India, where loyalty often matters more than discounts.

8. Categories Growing Faster Outside Metros

Fashion, ethnic wear, beauty products, affordable electronics, and home essentials perform exceptionally well. Groceries and quick commerce are slowly expanding beyond large cities.

These category trends show how Tier 2 and Tier 3 India is shaping demand differently from metros.

9. Meesho and Flipkart Proved the Model Works

Meesho focused on social commerce, women sellers, and small-town buyers. Today, nearly 80% of its orders come from Tier 2 and Tier 3 India.

Flipkart built kirana partnerships, local supply chains, and artisan programs. Over half its orders now come from outside the top cities. Both companies proved that real scale lies beyond metros.

10. The Road to 2030 Belongs to the Heartland

By 2030, experts expect over 70% of India’s e-commerce demand to come from Tier 2 and Tier 3 India. These cities could contribute more than $100 billion to the market.

For entrepreneurs, the message is simple. Ignore this shift, and you lose relevance.

Conclusion

India’s next e-commerce leaders will not be built only in metros. They will rise from smaller cities, regional markets, and local communities. With strong population growth, rising aspirations, and better digital infrastructure, Tier 2 and Tier 3 India has become the true growth engine of Indian e-commerce.

The goldmine has already shifted. Businesses that move early, build trust, and respect local needs will dominate the next decade.

Image Credits: Inc42

For more articles on startup growth, fundraising strategies, and business insights for Indian founders, visit: Udyamee India Magazine