Introduction

India’s digital payment journey has transformed rapidly, redefining how individuals and businesses manage money. With UPI (Unified Payments Interface) being used by millions daily, convenience has soared—but so has the risk. As 2025 unfolds, UPI Security stands as one of the most critical concerns for Indian businesses. While the fintech ecosystem grows, cyber threats are becoming smarter, and the implications are too costly to ignore.

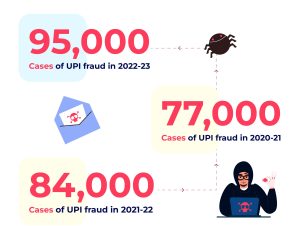

Evolving Threats in the UPI Landscape

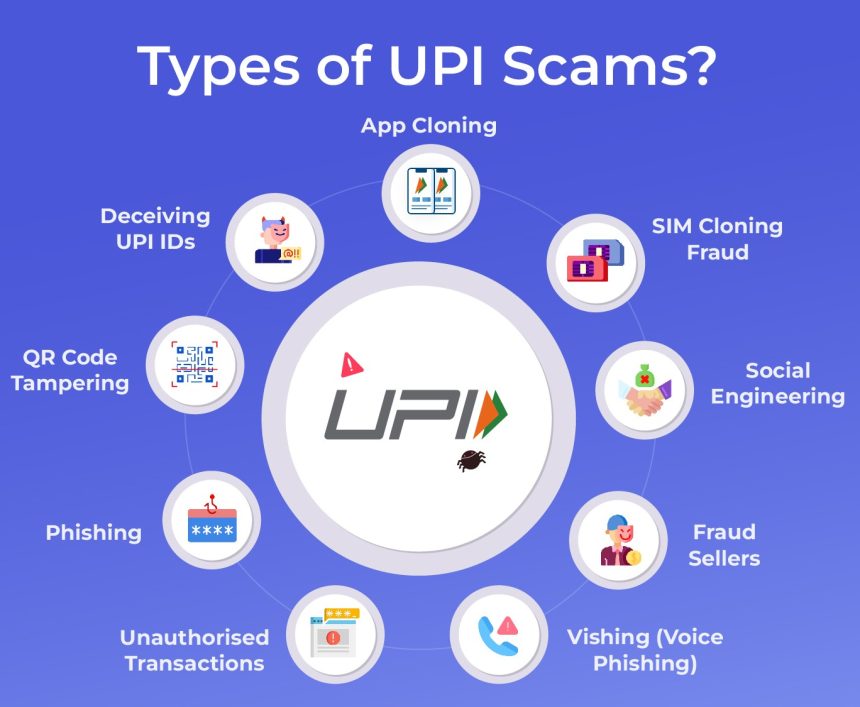

Over the last few years, India has witnessed a sharp increase in UPI-based fraud. These fraud tactics have advanced well past traditional phishing, now involving more sophisticated and deceptive methods. Fraudsters now use deepfake voices, AI-generated messages, and replica UPI apps to trick users. Scams involving QR code manipulation or fake refund links are on the rise, and many users still unknowingly fall prey. This shift requires businesses not only to protect their systems but to educate every stakeholder involved.

The Business Impact of Weak UPI Security

Many businesses wrongly assume that UPI fraud is only a consumer issue. The reality is far more serious. When fraud happens during a transaction with your platform, it doesn’t just cost the customer—it damages your reputation. Trust is a currency, especially in digital commerce, and even a single breach can lead to a loss of customer loyalty, negative reviews, and long-term revenue dips. UPI Security is now a core business requirement, not a technical afterthought.

Regulations and RBI’s Response

The Reserve Bank of India (RBI) and National Payments Corporation of India (NPCI) have not been silent spectators. To strengthen UPI Security, they’ve introduced measures like transaction caps, real-time fraud monitoring, and multi-factor authentication. However, implementation remains inconsistent. Many small and medium businesses are either unaware of these guidelines or don’t have the infrastructure to adopt them fully. The result? Vulnerability across platforms.

Why MSMEs Must Take the Lead

In a market where customers switch brands at the first sign of discomfort, micro, small, and medium enterprises (MSMEs) must view UPI Security as a strategic advantage. MSMEs have the agility to implement real-time changes, unlike larger corporates burdened by legacy systems. By proactively adopting fraud prevention measures, offering secure checkout experiences, and being transparent with users, MSMEs can position themselves as trustworthy alternatives in an increasingly cautious market.

Integrating UPI Security Into Your Business Culture

It’s no longer enough to secure the transaction process alone. UPI Security must be embedded into the culture of an organization. From regular employee training on fraud identification to user-friendly customer education, businesses need a 360-degree strategy. Whether it’s through secure payment gateways, verified APIs, or constant monitoring, companies must ensure that every digital touchpoint is fortified.

Technology as a Solution, Not a Threat

Ironically, the very technologies that are blamed for job losses and automation fears are also the tools that can safeguard businesses. A Technologies like AI, ML, and blockchain are now leading the way in strengthening the security framework of digital payments. These tools can detect anomalies in real time, flag suspicious activity, and automate fraud prevention. Businesses that embrace these innovations not only protect themselves but also enhance their customer experience.

Mental & Financial Cost of Fraud

What’s often overlooked in conversations about UPI fraud is the psychological toll. For small business owners and individual entrepreneurs, a financial loss from a scam can be devastating. It affects not just balance sheets but confidence. That’s why UPI Security is as much about mental peace as it is about technical safety. A secure business environment empowers entrepreneurs to focus on growth without fear.

The Future of UPI Security in India

As India pushes further into its digital decade, UPI Security will continue to evolve. Biometrics, encrypted tokens, and behavioral analytics will soon be standard features of digital payments. Businesses that act now—investing in awareness, training, and technology—will not just avoid losses; they will lead the market. The future belongs to brands that people trust with their money and data.

Conclusion

2025 is not just another year in India’s fintech journey—it’s a wake-up call. UPI isn’t just a payment tool anymore; it’s a trust agreement between the business and the customer. Rebuilding trust after it’s broken can be one of the toughest challenges for any business. Businesses that prioritize UPI Security today will not only protect their bottom line but also shape the foundation of a safer, more resilient digital India.

External Resources for Further Reading:

Image Credit: Decentro

For more such insights and updates on MSMEs and business trends in India, stay connected with Udyamee India Business Magazine.